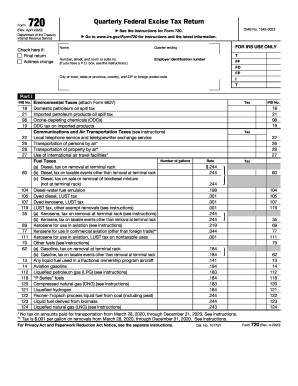

IRS 730 2017-2026 free printable template

Show details

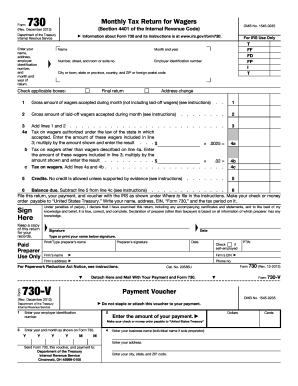

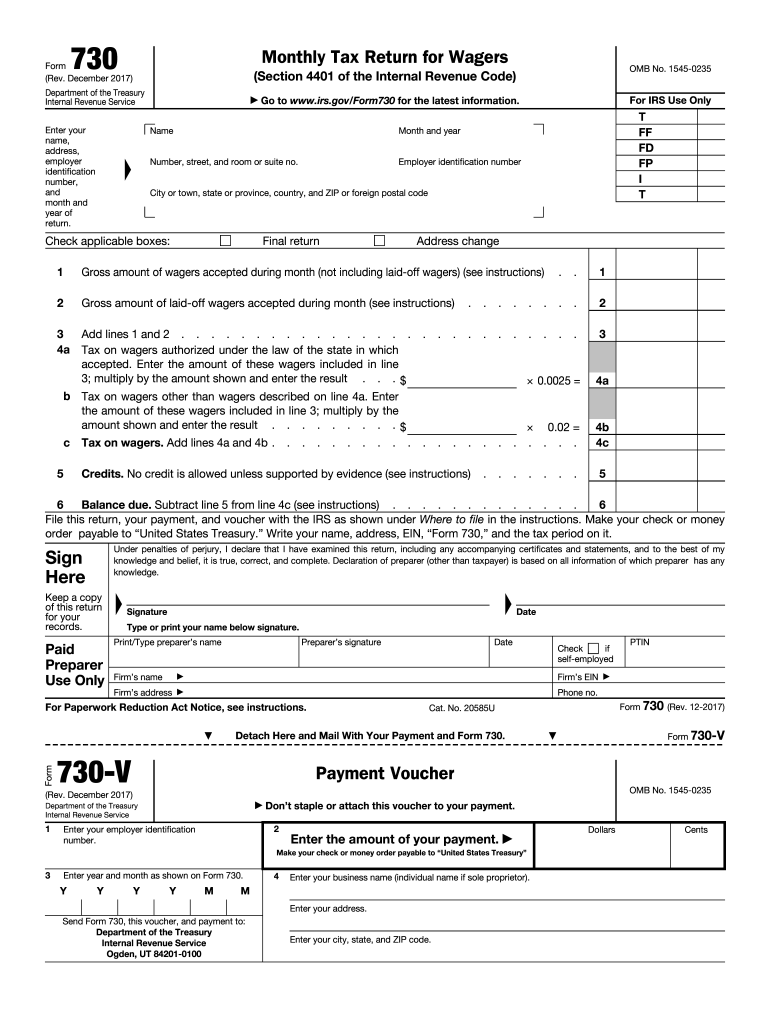

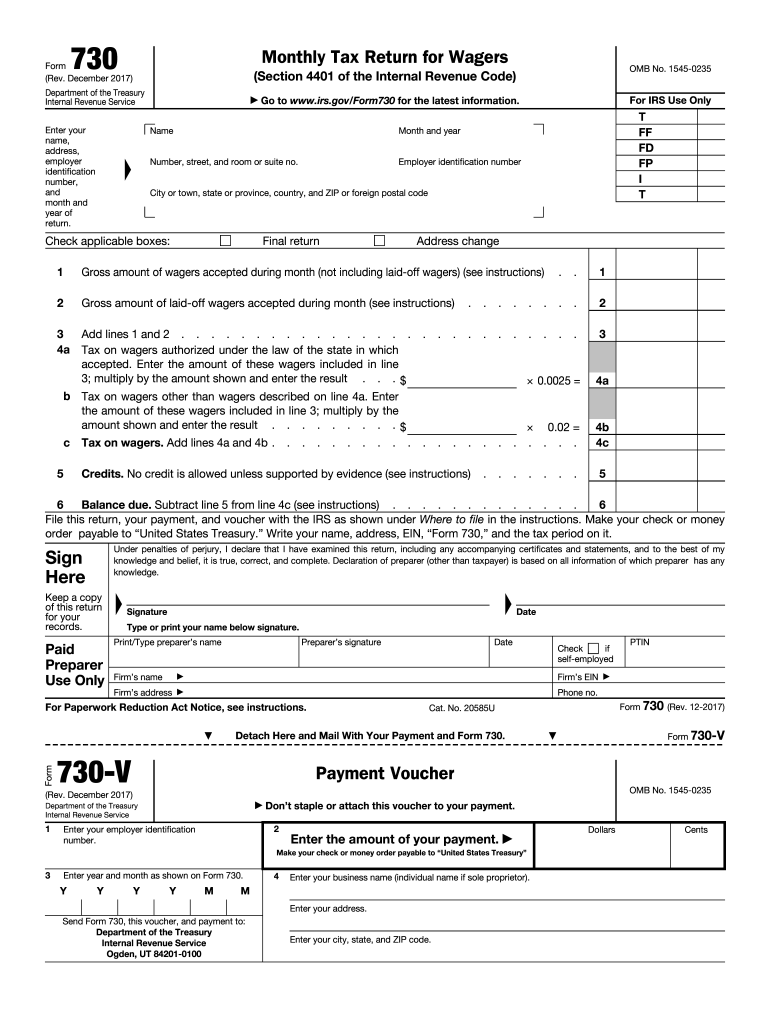

Enter the amount paid from line 6 of page 1 of Form 730. Box 4. Enter your name and address as shown on Form 730. Y Form 730 Rev. 12-2017 Payment Voucher PTIN Cat. No. 20585U Detach Here and Mail With Your Payment and Form 730. 730-V Form 730-V Don t staple or attach this voucher to your payment. Enter your employer identification Enter the amount of your payment. Don t send cash. Don t staple this voucher or your payment to Form 730 or to each other. Detach the completed voucher and send it...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 730

Edit your i 730 refugee asylee relative petition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 730 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs 730 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit download 730 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 730 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 730 pdf form

How to fill out IRS 730

01

Obtain IRS Form 730 from the IRS website or local IRS office.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Indicate the period for which you are reporting on the form.

04

Complete the section that details your taxable activities related to wagering.

05

Calculate your total tax liability based on the wagers placed.

06

Report any adjustments or credits applicable to your situation.

07

Sign and date the form to certify that the information is correct.

08

Send the completed form to the specified IRS address for processing.

Who needs IRS 730?

01

Persons or businesses engaged in wagering activities who owe federal excise tax.

02

Individuals who operate a gambling business and are required to report their tax liabilities.

03

Those who have made taxable wagers, as defined by the IRS, during a specific reporting period.

Fill

form 730 irs

: Try Risk Free

People Also Ask about revenue code 730

What is the address for Department of Treasury Internal Revenue?

300 N. Los Angeles St. Monday through Friday, 8:30am to 4:30pm. To navigate, press the arrow keys.

What is IRS Form 11 C?

This form is used by principals or agents who accept taxable wagers: to register certain information with the IRS, and. to pay the occupational tax on wagering.

Where do I mail my IRS Form 730?

Addresses for Forms Beginning with the Number 7 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 730 Tax on WageringDepartment of the Treasury Internal Revenue Service Ogden, Utah 84201-010017 more rows • Nov 29, 2022

What is IRS Form 730 for?

You must file Form 730 and pay the tax on wagers under Internal Revenue Code section 4401(a) if you: Are in the business of accepting wagers, Conduct a wagering pool or lottery, or. Are required to be registered and you received wagers for or on behalf of another person but did not report that person's name and address

Where to mail form 720 Quarterly Federal Excise tax return?

Addresses for Forms Beginning with the Number 7 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 720 Quarterly Federal Excise Tax ReturnDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-000917 more rows • Nov 29, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify rev code 730 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 1091 tax form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete 730 form online?

pdfFiller has made it easy to fill out and sign 730 download. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit file 730 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 8453, you need to install and log in to the app.

What is IRS 730?

IRS 730 is a form used to report and pay the federal excise tax on the use of gasoline, diesel fuel, and other motor fuels that are used on highways.

Who is required to file IRS 730?

Persons or businesses that produce, sell, or use taxable fuel in the United States generally must file IRS 730 if they owe federal excise taxes on motor fuel.

How to fill out IRS 730?

To fill out IRS 730, you must provide your name, address, taxpayer identification number, and detailed information about the fuel used, the tax due, and any applicable credits or payments.

What is the purpose of IRS 730?

The purpose of IRS 730 is to collect the federal excise tax on certain fuels used in highway transportation and to ensure compliance with fuel tax regulations.

What information must be reported on IRS 730?

IRS 730 requires reporting information such as the amount of fuel used, the type of fuel, the total tax owed, any credits claimed, and payment details.

Fill out your IRS 730 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 730 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.